Wellsfargodealerservices is a notable car money organization and has been in the loaning industry for a long time. It offers serious places of interest. The most helpful approach to getting credit from this organization is through an online application. You need to fill in the vital subtleties and submit it on their protected site, and the data is prepared and affirmed by the organization. The organization offers various sorts of vehicle credits for various clients. You can pick your vehicle and apply for individual credit or a mix of vehicle advances. A blend advance is a point at which you join a few credits into one advance with a lower financing cost. You can apply for the same number of advances as you need.

Contents

Wells Fargo Dealer Services and Benefits

There is a Wells Fargo vendor administration that is intended for all zones, so you can glance through this site to check whether they can assist you with your record. This site will likewise furnish you with data on discovering nearby credit officials, agents, and different advances related data. Find out about retirement plans choices from voyaretirementplans.

You can likewise look at the Wells Fargo vendor administrations to discover how you can get limits on your buys.

Numerous vendors and organizations offer limits to their clients consistently, so you can exploit this kind of rebate on the off chance that you have a trader account with Wells Fargo.

- Account checking is another element of seller benefits that you can exploit.

- Account checking will assist you with keeping steady over what is new with your record.

- Account observing is something that will monitor your exchanges.

- The cautions that are given by this component will tell you when your card is pushed to the limit, your assertion is off base and the sum owed on a specific record is incorrect.

With regards to consumer loyalty reviews, you might need to investigate the consumer loyalty overview that is accessible for you. This will permit you to find solutions to any inquiries that you may have, so you can perceive what others have needed to state about your administration from your organization.

Read more articles like this from mycrickethighlights, myfirstpremiercard, icanhascheezburger, northshoreconnect, myprogramminglab, pearsonmylabandmastering, wellsfargodealerservices, exxonmobil.accountonline

- A consumer loyalty review is one of the main things that you can do to ensure that you are happy with your organization.

- By posing inquiries to find solutions to them, you will have the option to become familiar with your administration from the organization.

- These are only a portion of the various things that you can get from the Wells Fargo vendor benefits that are accessible.

- The rundown isn’t finished, yet it will give you a thought of what you can anticipate from your vendor administration.

In what manner would wellsfargodealerservices be able to support you?

An advance with a lower loan cost would empower you to pay an appropriate regularly scheduled payment to the bank at a customary stretch. This will be simpler for you and less confounding for the loan specialist also. At the point when you pick an advance from the organization, you can apply to have a home loan, credit extension, or a vehicle regarding the guarantee for the advance sum. You should give a portion of your own data, for example, your personal residence, business subtleties, pay subtleties, and so forth.

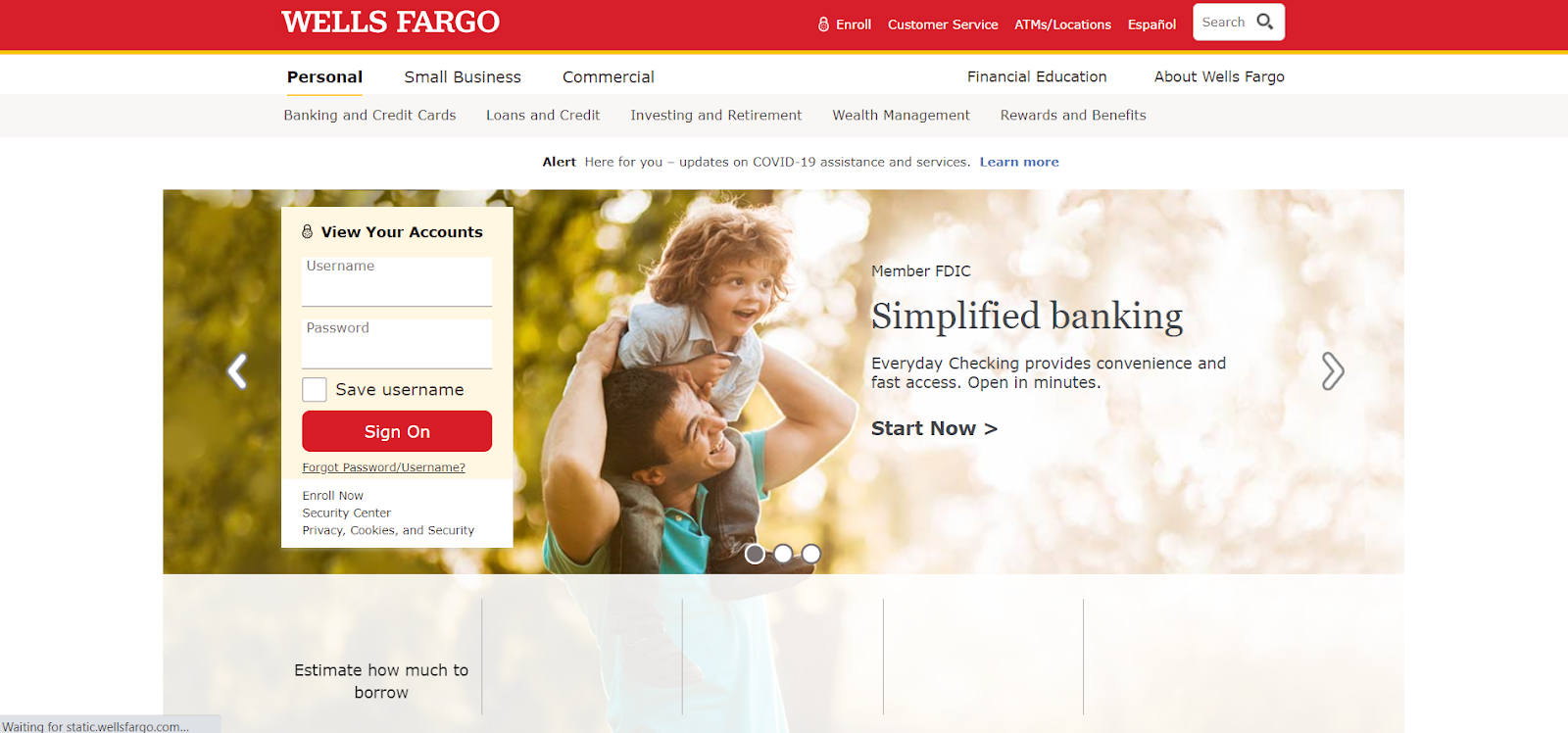

Online applications for WellsFargoDealerServices

Online application for an advance is simple. You simply need to top off the necessary subtleties, submit it, and sit tight for your endorsement. You should give subtleties of the current FICO scores of the borrower. You likewise need to turn out revenue data and government forms.

- Well, you can likewise get exhortation from your bank or the organization prior to applying for the credit. You have to get some information about the terms and states of the credit. They will likewise have the option to inform you regarding the loan specialists who offer the best rates.

- If you are looking for the best arrangement then it is smarter to experience the organization to see if the organization can give you the credit. Subsequent to getting the data from the organization, you can continue to top off the online application frame and submit it. The moneylender will check your subtleties, confirm the data, and will settle on the choice appropriately.

Click here to find more articles on cricoff.com/mycrickethighlights, firstpremier.com/myfirstpremiercard, icanhas.cheezburger.com, Northshoreconnect.org/signup, Pearson.com/myprogramminglab, login.planningcenteronline.com, pearsonmylabandmastering.com/signin, wellsfargodealerservices.com/login, exxonmobil.accountonline/login

How to decide the correct loan from WellsFargoDealersServices?

It will require some investment to locate the correct advance for you. You have to invest some energy to research and analyze statements and think about the rates prior to settling on an ultimate choice. Indeed, it is significant that you don’t defer in settling on an official choice since you can get dismissed.

1. If you have questions in regards to an organization, it is smarter to talk about these with the organization prior to concluding the arrangement. You should comprehend your obligations prior to taking up the advance.

2. If you can’t bear to repay the vehicle advance in full then you can choose portion advances. With portion advances, you can undoubtedly take care of the advance sum in simple regularly scheduled payments.

3. You can undoubtedly get this kind of credit with no problem. In any case, when the credits are finished, you have to reimburse it in full so as to keep away from any sort of punishments or added charges.

Conclusion

The rates for portion advances are unique in relation to one loan specialist to another. A few moneylenders may charge a higher financing cost, while different banks may charge a less expensive loan fee. On the off chance that you are searching for a low financing cost, at that point you may consider selecting an awful credit advance that has a generally lower pace of interest. All things considered, on the off chance that you are searching for an advance to buy a vehicle then it is prudent to go for a decent account organization that will assist you with purchasing a vehicle with the most ideal credit. Notwithstanding, you ought to experience the subtleties cautiously to guarantee that you are settling on an educated decision.